KEY POINTS

Gold

- Breaks out of pennant

- Option expiry volatility

- Ready to move higher now

Gold stocks

- Sentiment still poor

- Option expiry selloff

- Supporting on downtrend

- Gold stocks vs Gold

- Reversal pattern developing

Stocks

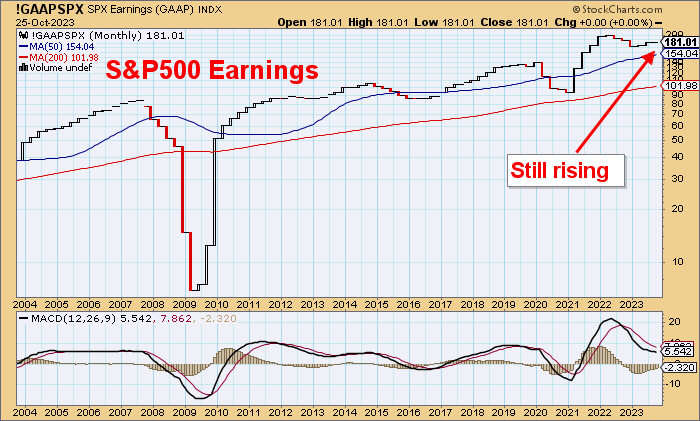

- Earnings still rising

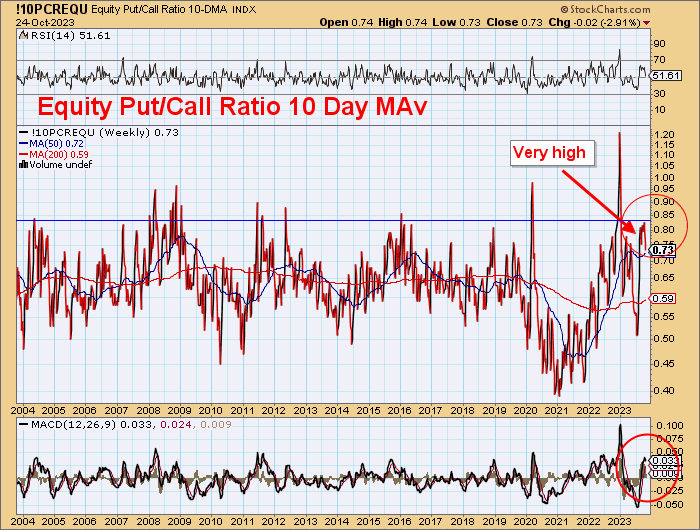

- Market sentiment is pessimistic

- Banks underpressure

- COVID drug stocks collapsing

Bonds

- Close to the bottom for bonds – soon?

- Yields still in parabolic exhaustion

Currencies

- Another breakdown of

- Yen

- Euro

- Sterling

- US$ higher

Gold moved higher overnight with a spike to US$1987 as option expiry ran its course.

Manipulation, as usual with gold stocks hit, and given the poor sentiment here, it probably wasn’t too difficult to do.

But gold stocks seem to be finally setting up for a reversal vs gold.

US$ is stronger, and the Yen and Euro look like they are cracking again.

Bond yields have moved higher, but it still looks like peaking.

Equity pessimism is still high and can support a bottoming and reversal higher.

Put-to-call ratio remains high and positive for a short cover here.

Gold has popped out of this pennant and is in another continuation pattern.

Large volume through again.

The current technical position looks very positive.

Consolidation at the previous highs in July and so should move higher easily.

This does look very good.

Gold stocks have been in decline against gold since the July highs and have not been following gold higher in the latest move.

This suggests that a powerful break to the upside is likely.

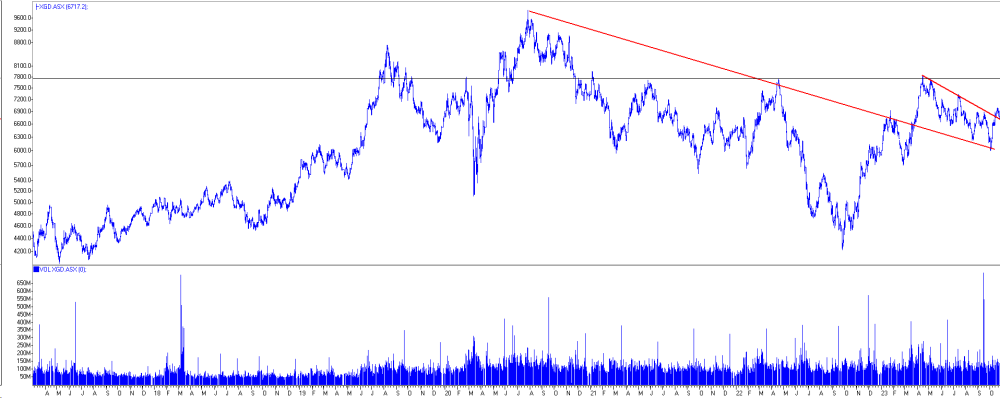

Compression between the July downtrend and rising support within a larger wedge is indicating some power is about to be released.

Likely to be next week.

Sentiment in gold stocks has yet to pick up significantly despite gold rising.

But the technicals here are very constructive.

A RHS is being formed as the XAU supports the downtrend after initially breaking out.

Just the usual break out and back test before surging.

Next week, it seems will be the timing.

ASX Gold Index is currently performing in a similar manner to its Nth American counterparts.

Forming that RHS.

US Stocks

- Earnings still rising

- Market sentiment is pessimistic

- Banks underpressure

- COVID drug stocks collapsing

The bears are still in the ascendancy and not too far from recent historic highs.

And Put/Call ratio is in the upper levels of pessimism.

Banks and the finance sector have very good earnings, but banks are still having real difficulties with the values of their bond portfolios.

Might the lows for bonds be very close, and this index be close to its bottom?

The vaccine stocks are collapsing.

Bonds

- Close to the bottom for bonds – soon?

- Yields still in parabolic exhaustion

Perhaps a little lower here, but not much.

How far will this parabola run?

Currencies

- US$ heading up in next leg

- Yen about to really crack

- Stock market to rally

- Euro has had its backtest and is now failing again

This looks horrible.

It's interesting that the last line of support is at the Devil’s Number of 666.

The Tokyo stock market should surge here as the currency falls.

The Euro has peaked and is about to head lower.

Will the Euro even still be around by the end of 2025?

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.